The TaxCloud integration allows you to calculate the sales tax for every address in the United States and keeps track of which product types are exempt from sales tax and in which states each exemption applies. TaxCloud calculates sales tax in real-time for every state, city, and special jurisdiction in the United States.

Configuration

In Tax Cloud

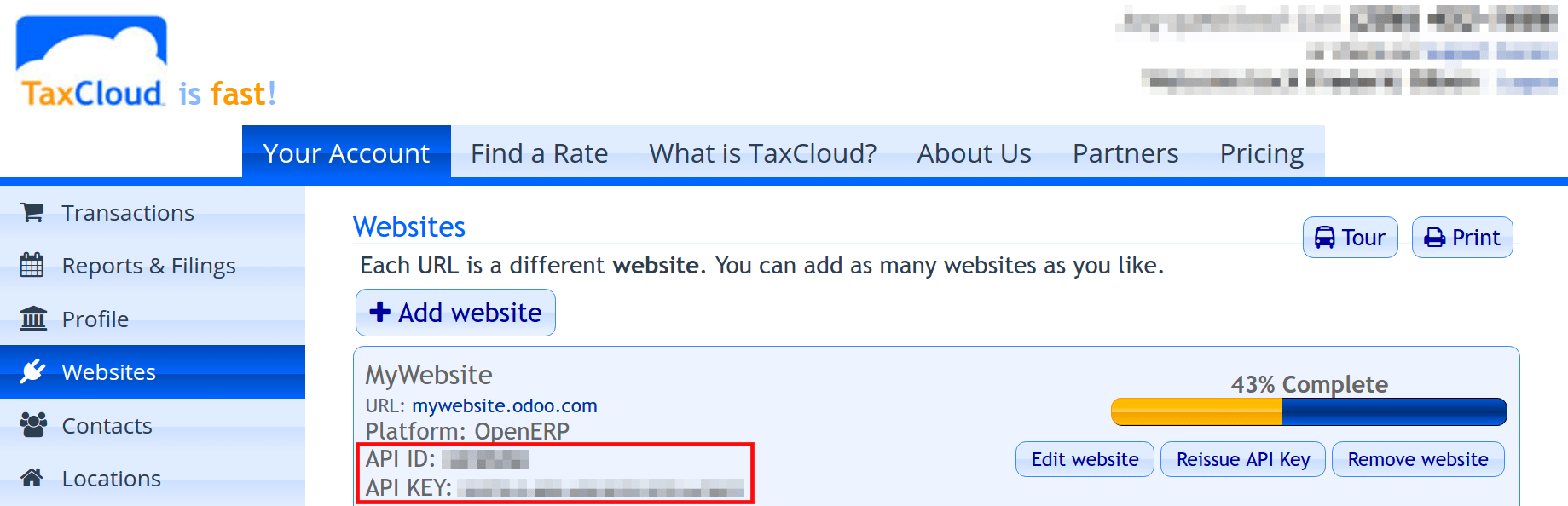

- Create a free account on *TaxCloud* website.

- Register your website on TaxCloud to get an API ID and an API Key.

In Odoo

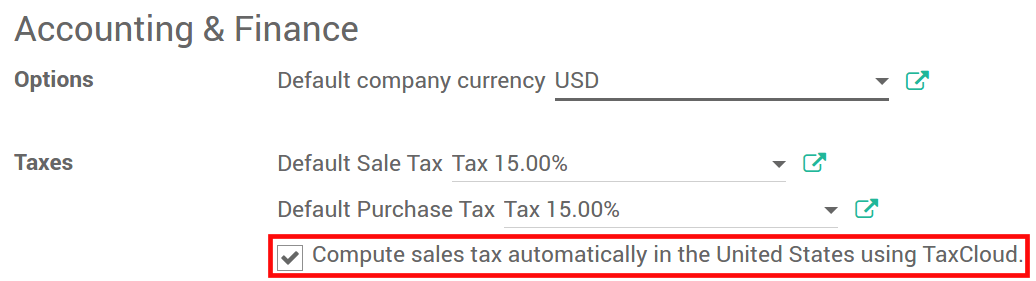

- Go to Invoicing/Accounting ‣ Configuration ‣ Settings and check Compute sales tax automatically using TaxCloud. Click Apply.

- Still in those settings, enter your TaxCloud credentials.

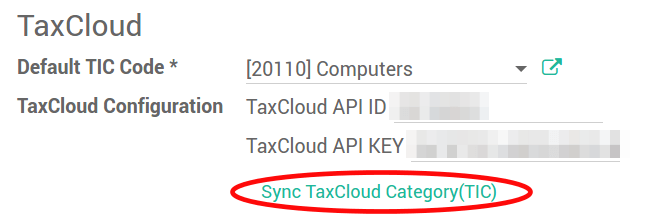

- Hit Sync TaxCloud Categories (TIC) to import TIC product categories from TaxCloud (Taxability Information Codes). Some categories may imply specific rates.

- Set default TIC Code and taxe rates. This will apply to any new product created. A default sales tax is needed to trigger the tax computation.

- For products under a specific category, select it in its detail form (in Sales tab).

- Make sure your company address is well defined (especially the state and the zip code). Go to Settings ‣ General Settings and click Configure your company data.

How it works

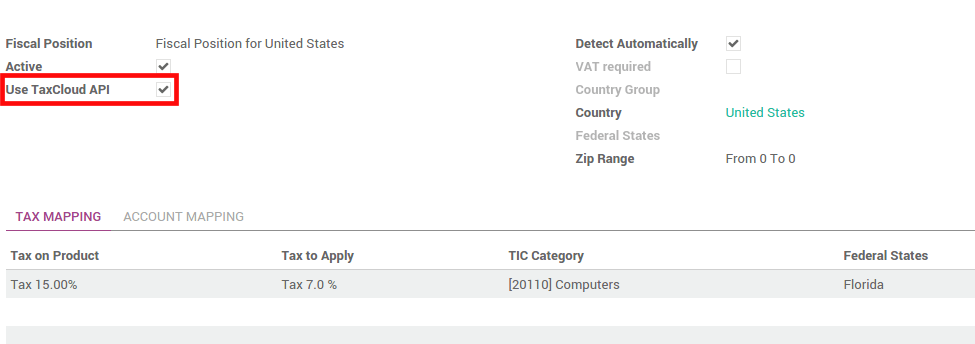

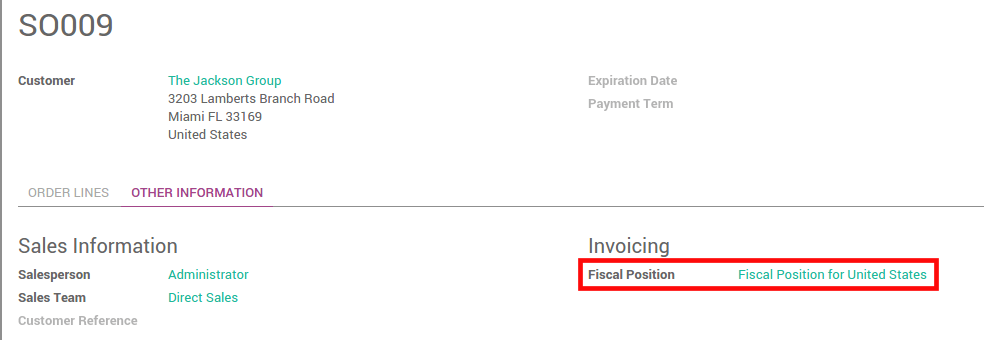

Automatic tax assignation works thanks to fiscal positions (see How to adapt taxes to my customer status or localization). A specific fiscal position is created when installing TaxCloud. Everything works out-of-the-box.

This fiscal position is set on any sales order, web order, or invoice when the customer country is United States. This is triggering the automated tax computation.

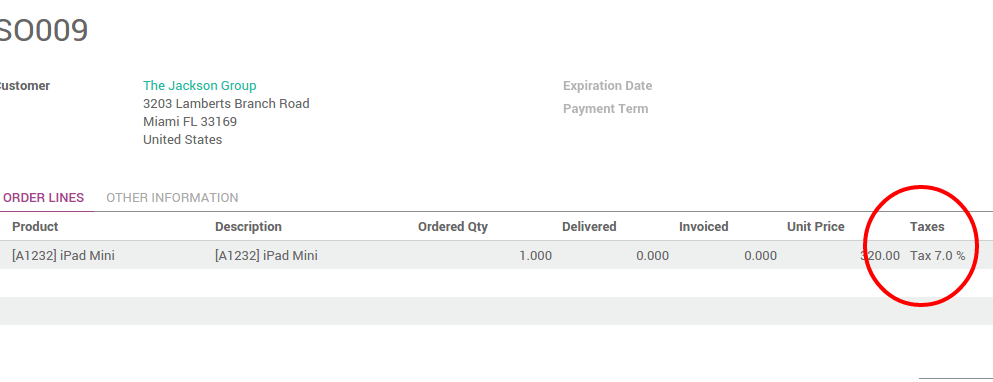

Add a product with a default sales tax. Odoo will automatically send a request to TaxCloud, get the correct tax percentage based on the customer location (state and zip code) and product TIC category, create a new tax rate if that tax percentage does not already exist in your system and return it in the order item line (e.g. 7.0%).

How to create specific tax mappings using TaxCloud

You can create several fiscal positions using TaxCloud. Check Use TaxCloud API to do so. Such fiscal postions can be assigned to customers in their detail form in order to get them by default whenever they buy you something.